The government has confirmed plans to merge AT Ghana (formerly AirtelTigo) with Telecel Ghana in a move it says is critical to saving the struggling operator and strengthening competition in the telecom market.

According to the Ministry of Communications, Digital Technology and Innovations, the decision follows years of steep financial losses at AT Ghana that have become a burden on the state.

At a staff engagement in Accra, Minister Samuel Nartey George assured AT employees that no jobs would be lost in the process. He stressed that the merger is not a fresh recruitment exercise but rather a continuation of existing contracts. Customers, too, are expected to have their interests safeguarded as the transition unfolds.

AT’s Financial Woes

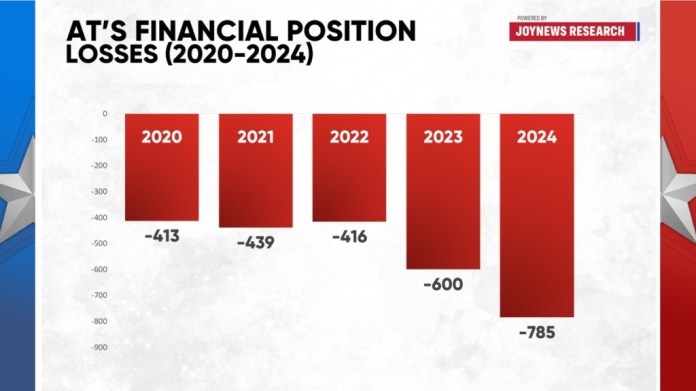

The numbers paint a grim picture. In the first eight months of 2025 alone, AT recorded losses exceeding $10 million. The 2024 State Ownership Report showed a massive GH¢785 million loss for that year, pushing the company’s cumulative losses over the past five years to GH¢2.7 billion.

Its debts now stand at GH¢3.6 billion, overshadowing equity valued at GH¢2.8 billion. In effect, if AT Ghana were sold today, its liabilities would outweigh its assets — making continued state bailouts unsustainable.

Shaking Up the Market

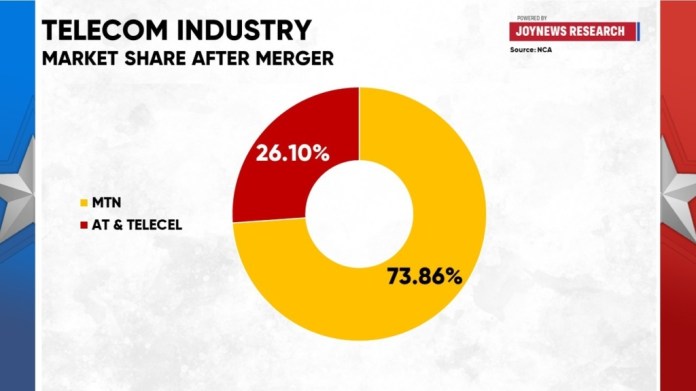

Beyond rescuing AT, the merger aims to rebalance Ghana’s highly concentrated telecom sector. National Communications Authority (NCA) data shows that MTN commands an overwhelming 73.9% share with 29.5 million subscribers. Telecel holds 18.3% (7.29 million), while AT lags far behind with 7.9% (3.15 million).

Combined, Telecel and AT would control 26.1% of the market — a total of 10.44 million subscribers — solidifying their place as the second-largest operator. Still, MTN would remain far ahead with nearly 19.5 million more subscribers.

The Three-Phase Integration

The merger will unfold in three stages:

-

Technical Migration: Already 98% complete, with over 3.2 million AT customers shifted to Telecel’s infrastructure under a national roaming arrangement.

-

Human Resource Alignment: All 300 AT staff are expected to be fully absorbed by the end of September.

-

Commercial Restructuring: To establish the new business framework of the merged entity.

The government estimates the new operator will require $600 million in fresh investment over the next four years, sourced from spectrum sales, Telecel, and other strategic partners.

What It Means for Consumers

For subscribers, the immediate benefits may include stronger network quality, faster internet speeds, and potentially more competitive data bundles from a stronger Telecel.

However, analysts caution that MTN’s dominance makes aggressive price reductions or a full-blown price war unlikely in the short term.

The Bigger Picture

Ultimately, the government’s intervention seeks to:

-

Ease the financial burden on taxpayers

-

Protect jobs in the sector

-

Boost competition in Ghana’s telecom market

Whether this merger will truly shift the balance of power in the industry remains uncertain. For now, MTN’s towering dominance continues to define the landscape — and the merged Telecel-AT entity has a steep climb ahead.

source: myjoyonline